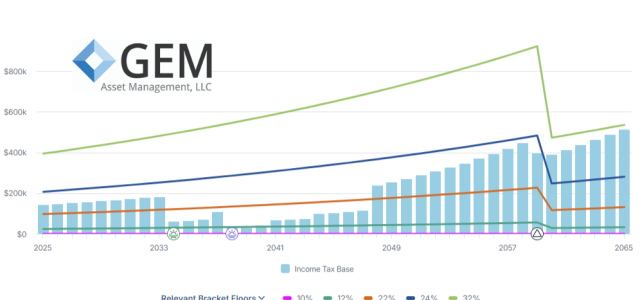

The Big Picture — The US has a progressive tax system in which gradually higher rates are assessed on higher levels of income. For example, an individual

Fall is a time of harvest. Ready to be picked are bright red apples in the trees, bulging pumpkins in the field and unfortunately, losses in taxable portfolios

What Happened — Despite a great deal of economic and political uncertainty, stocks were solidly higher in the quarter and extended their gains for the year

Last month, President Trump made an executive order creating a pathway for certain “alternative assets” to be included as investment options in 401k plans

At GEM, we often work with several generations in managing families’ wealth. That work can vary, but at the moment we are helping to settle several estates

What Happened — Labor market data released on Friday sent the stock market lower. The unemployment rate held fairly steady, however, payroll data tracking the

Big Picture — After much deliberation, Congress recently passed the “One Big Beautiful Bill Act of 2025” (OBBB). The main result for taxpayers is that it

Big Picture — It’s hard to believe we are half way through the year, but all-in-all we find the market in a pretty good place after the first six months. After

We recently began a look into the complexities involved in passing on individual retirement accounts with a look at the basic rules. The rules of how inherited

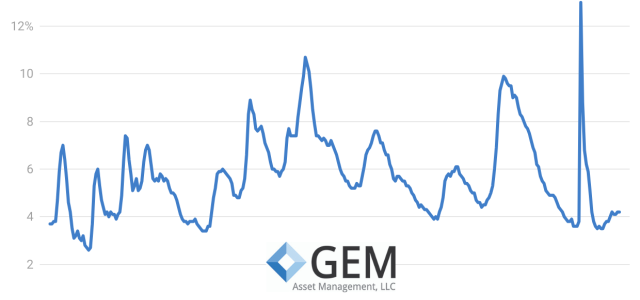

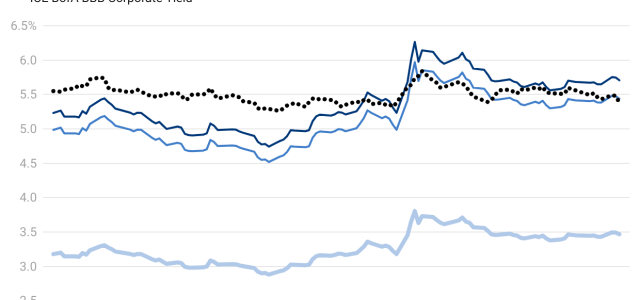

Municipal bonds are a sometimes overlooked corner of the bond market, but for some investors they may be a place to find real opportunities.

The Basics — Munic

Individual Retirement Accounts first became available in 1975, and in the 50 years since they have become a major part of how Americans build wealth and save

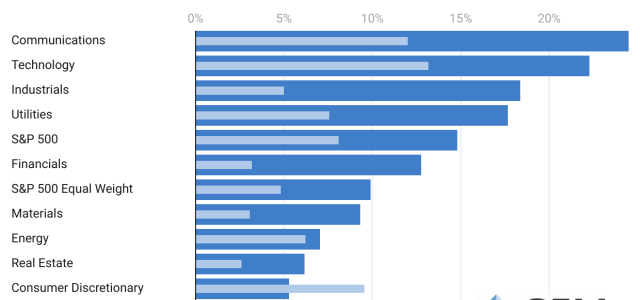

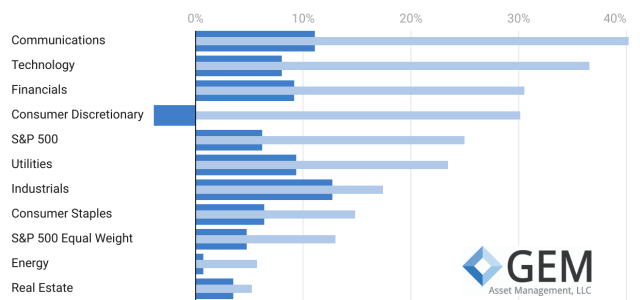

Index fund investing has grown in popularity among many investors. The concept has many real advantages — scant research, no trading and minimal costs. The