Mid-Year Look

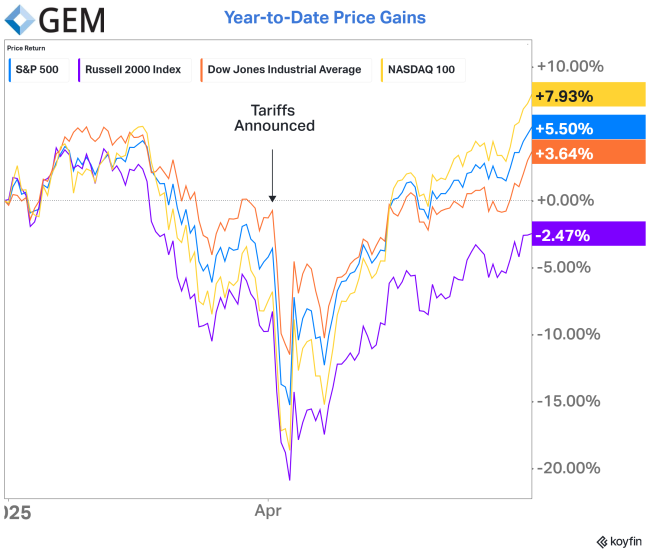

Big Picture — It’s hard to believe we are half way through the year, but all-in-all we find the market in a pretty good place after the first six months. After a decent, but not quite robust start to the year, the market began to fret about the impact of tariffs. When they were ultimately announced in early April, shares took a dramatic tumble. Then after about two or three weeks, the market decided the tariffs didn’t really matter after all and rebounded to new highs.

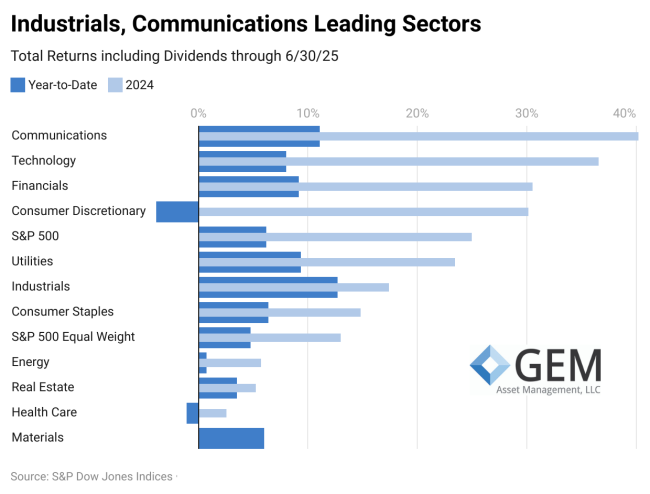

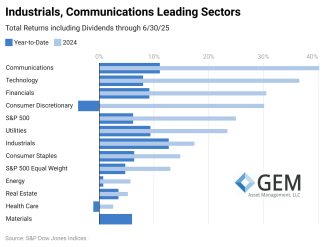

Looking Closer — Last year’s leading sectors were Communications, Technology and Financials.

- Those sectors have performed well again in 2025, albeit not at quite the same pace as last year.

- Consumer Discretionary was a top performer in 2024, but economic concerns and an absence of interest rate cuts have made it the worst performing sector this year.

Defensive Stocks — Not everyone is convinced that tariffs won’t slow down the economy. Defensive sectors like Utilities and Consumer Staples are having a decent year, although Healthcare is down year-to-date.

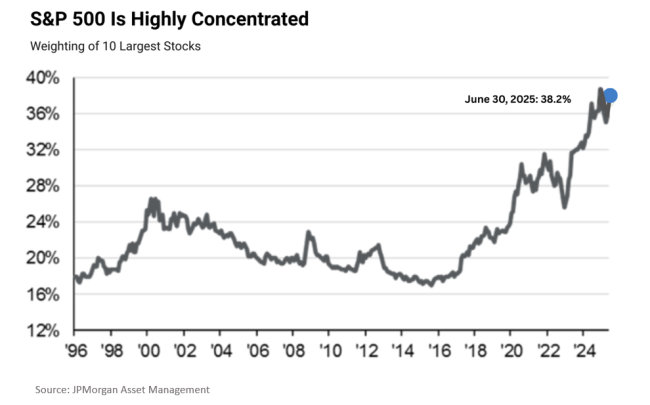

Top weighted — S&P 500 members are weighted within the index by size, and the index remains highly concentrated as those largest companies have continued to grow. These stocks’ share price performance has cooled a bit, but their weighting still drives the market.

- Three of the “Magnificent 7” companies were responsible for just over half of the S&P 500’s 6.2% total return (with dividends) since the start of the year — Microsoft, NVIDIA and Meta Platforms.

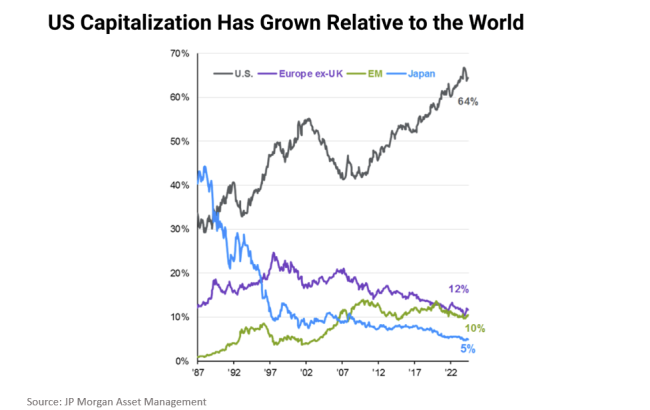

US vs the World — The performance of the largest companies has not only increased concentration within the US stock market, but it has driven the US share of the global equity markets. US stocks have outperformed the rest of the world for roughly the last 15 years.

Looking Ahead — At this risk of sounding trite, we believe a well-diversified, globally-allocated portfolio offers opportunity. International stocks have outperformed US in 2025, and they have some runway ahead of them.

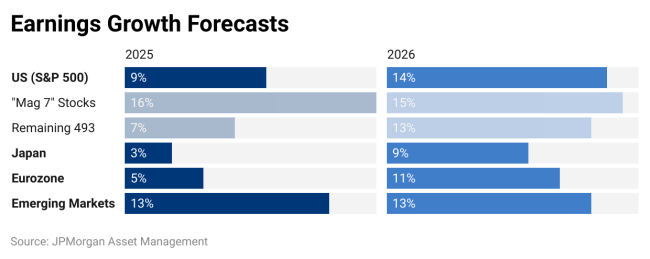

- The Mag 7 stocks are still expected to grow, but not at the same pace as previous years. NVIDIA is the only one with greater than 25% expected EPS growth.

- The remainder of the S&P 500 and many international equity markets are forecast to have accelerating earnings growth.

Looking Ahead — At this risk of sounding trite, we believe a well-diversified, globally-allocated portfolio offers opportunity. International stocks have outperformed US in 2025, and they have some runway ahead of them.

- The Mag 7 stocks are still expected to grow, but not at the same pace as previous years. NVIDIA is the only one with greater than 25% expected EPS growth.

- The remainder of the S&P 500 and many international equity markets are forecast to have accelerating earnings growth.

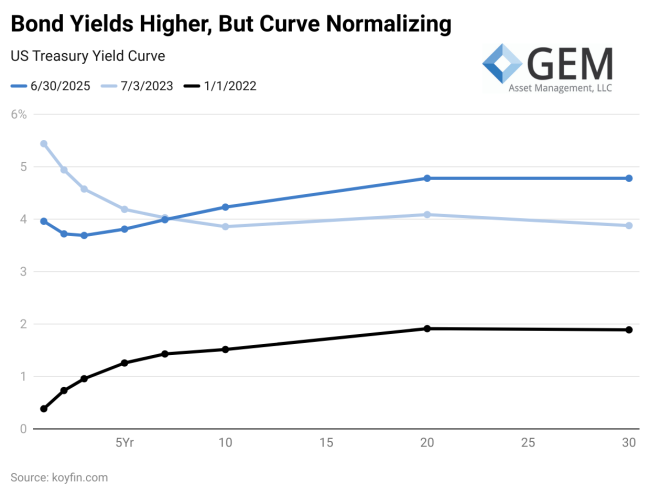

Bonds & Rates — Despite expectations, the Federal Reserve has not yet cut rates in 2025. Longer term interest rates actually rose following the cuts late last year. The Fed has said they are cautious about tariffs re-igniting inflation, and strength in the job market is not pressuring them to cut.

- The markets are currently looking for two rate cuts of 0.25% each by the end of the year. Should that occur, we would expect shorter term rates to decline and long-term rates to hold, reflecting continued concerns over the size of the Federal debt.

- Over the next several years, we expect bonds overall to generate average annual returns of around 4%-5% from these levels.