Bracket Management

The Big Picture — The US has a progressive tax system in which gradually higher rates are assessed on higher levels of income. For example, an individual taxpayer would owe 10% in taxes on the amount they earn up to $11,925. Then they would owe 12% on amounts above that up to $48,475. These income ranges are known as tax brackets. Whatever rate is taxed on someone’s next dollar of income is called their marginal tax rate.

Tax Planning 101 — Timing when income is received in order to avoid paying at higher rates is the core of tax planning. Given the choice, it is more beneficial to recognize income in a period when the marginal rate is lowest. Sometimes there is no option. Wages, interest and dividends are taxed in the year they are received. But, it can be possible to time investment sales that create taxable gains, or when to take distributions from qualified retirement accounts.

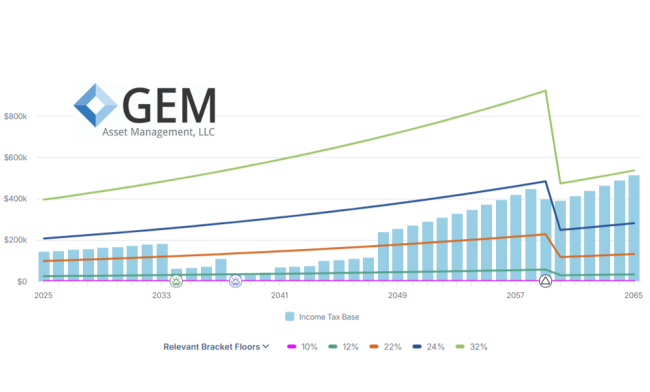

Planning Example — The graphic below is a sample created using our planning software. The blue columns are the taxable income base for a hypothetical two-income couple who are currently working, but plan to retire when each turns 65. The colored lines show the levels of income taxed at each of the rates.

Maximizing Lower Brackets — When each spouse turns 75 they will be required to take taxable distributions from their respective retirement accounts (non-Roth). Before then, they would have the option of taking distributions that may be taxed at a lower rate. Those distributions would reduce the amounts required in later years that would be taxed at higher rates. The goal would be to recognize as much income as they can below the lowest line possible.

Avoid the Bigger Hit — For this example, the difference between the 22% and 24% brackets may not seem that consequential, but it is still thousands of dollars each year. Major savings potential from tax planning comes at the right of the graphic when one of the fictitious spouses dies. The surviving spouse has all the required distributions, but their filing status changes from married to single, propelling them into a much higher tax bracket.

Estate Issues — When the second spouse passes, the heirs would be required to fully withdraw the retirement fund balances in just ten years. If these heirs are still working and have a significant income, their marginal rate could be even higher.

Timing tax distributions and converting retirement assets to Roth accounts are options worth exploring. Tax planning helps to preserve as much of the wealth you have earned, both for yourself and your heirs.