Harvest Time

Fall is a time of harvest. Ready to be picked are bright red apples in the trees, bulging pumpkins in the field and unfortunately, losses in taxable portfolios. Active investing is bound to create some losers, even in good years, and tax loss harvesting is a solid strategy for active investors.

Now is the time to do it. While it’s a good strategy to harvest losses for tax purposes, they are still losses and it’s best to avoid further declines. Research has shown that the year’s worst performing stocks up to the end of August, on average underperform the other stocks by 2-3% through the end of the year. As retail investors sell positions for tax losses and institutions “window dress” their portfolios for reporting, the additional selling pressures pushes these shares further down.

The Basics — Tax loss harvesting is a strategy for taxable investment accounts where you identify investments trading below where they were purchased, then selling them to “harvest” the loss. This is an important strategy because the losses can be used to offset capital gains, thereby reducing the tax due. Losses in excess of gains can be used to offset ordinary income, or carried forward to use in future tax years.

Be Careful — You can re-invest the proceeds of the sale in another security, but the IRS may disallow the loss if you buy a “substantially identical” security within 30 days. This is called a wash sale.

Example — A married couple in the 32% tax bracket has a $30,000 capital gain from investment sales. They are holding a position in a security which is currently down $35,000 from purchase, but they believe certain factors will benefit the company’s share price and it will recover. They sell the shares to harvest the loss, and reinvest the proceeds in shares of another company that will also benefit from those factors, but avoids the wash sale rule.

The sale offsets the original gain which saves $4,500 in capital gains tax (15% capital gains tax rate). $3,000 of the remaining loss can be used to reduce ordinary taxable income reducing their tax bill by another $960. The remaining $2,000 of loss can be carried forward to offset gains or income on a future year’s return.

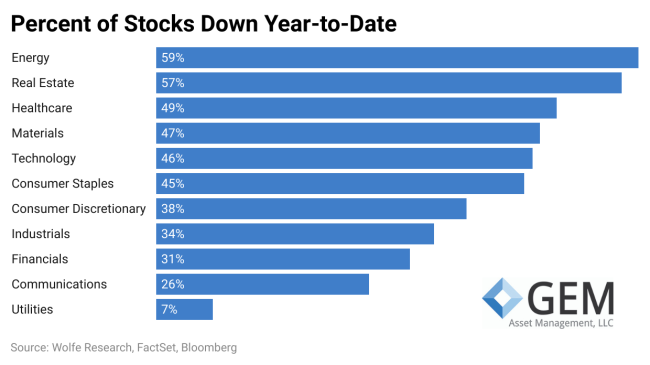

Where to Look — The market has done well this year. The S&P 500 is up 13.7%; Nasdaq Composite has gained over 17%. But remember, these indices are weighted by size and dominated by larger companies, despite these gains just 60% of large-cap stocks are up for the year.

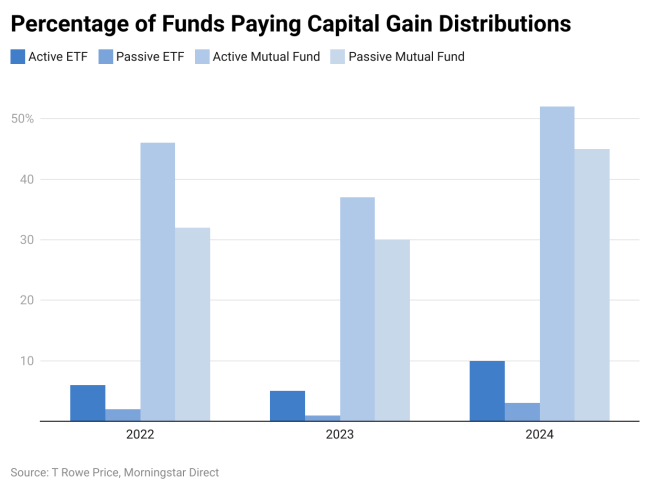

Mutual Funds — Investments in individual securities create capital gains or losses only when the investor sells them. Mutual funds create capital gains and losses as they sell positions through the year and they are required to pay the gains out in distributions to shareholders even though the investors did not sell any fund shares.

Investors should be wary of buying mutual fund shares in taxable accounts close to year-end. The net asset value of the shares purchased may include an amount of capital gains that will be shortly distributed. You will need to recognize that gain very shortly and pay taxes on it.

TIP — A better choice for taxable investments are exchange traded funds, or ETFs which tend to be a much more tax-efficient investment. Because of the way they are structured, they rarely have to sell the securities they hold and so typically generate a capital gain or loss only when the investor sells it. This can help to defer the taxes due into the future.

Using tax-efficient investment strategies like tax loss harvesting can be very beneficial, but identifying and executing them can be complex and time-consuming. If you’re seeking ideas or want a second opinion, we’d welcome the conversation.