Third Quarter Lookback

What Happened — Despite a great deal of economic and political uncertainty, stocks were solidly higher in the quarter and extended their gains for the year. Investors looked through the noise and rallied after the Federal Reserve’s long-anticipated cut to its key interest rate.

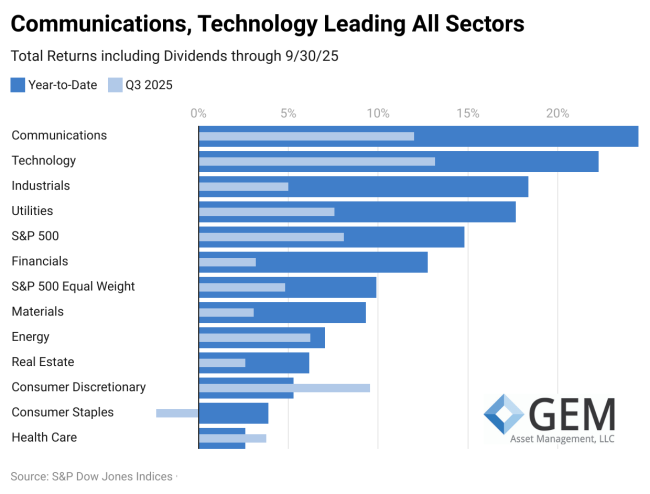

Behind the Numbers — Stocks associated with AI continue to outperform and market concentration is extremely high. The weighting of the 10 largest companies is now over 40% of the S&P 500. All sectors are up so far in 2025 and sentiment is high for the market. Defensive sectors like Consumer Staples and Healthcare are being largely passed over.

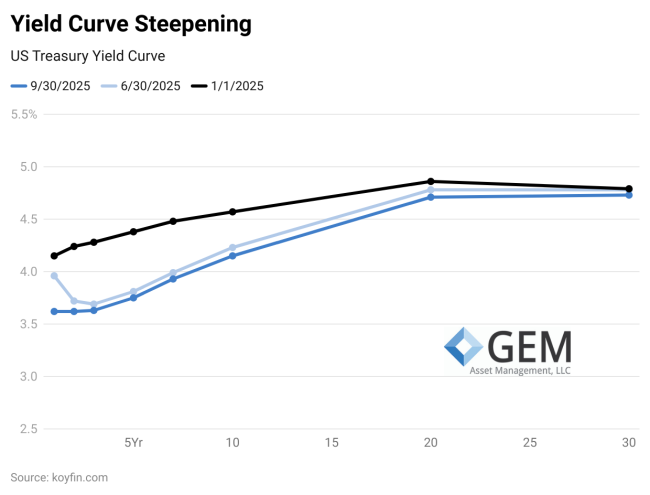

Interest Rate Cuts — The Federal Reserve delivered the rate cut the stock market and White House wanted. There seemed to be enough cracks in the labor market to force their hand despite inflation data that has not been as low as desired. Comments from the Fed seemed to indicate they plan to cut a quarter percent at both of the remaining meeting this year. Markets are putting an 84% probability rates will be 0.50% lower by year-end. Short and intermediate-term yields dropped in anticipation. The shortest-term yields were hanging in a touch higher because of uncertainty around the timing of the cuts, but have now come in-line. The yield curve is steepening because long-term yields are holding up because of concerns about the growing size of outstanding Treasury debt.

What it means — Lower rates help stock prices in a couple of ways. First, they boost valuation price multiples, because low rates make future cash flows worth more. Second, they lower the costs of borrowing for companies aiding growth and profitability.

Small cap stocks reacted most to the rate cuts, and their performance has trailed large caps for some time. Investors may be wondering if now is their time. Historically, small caps have shown strong seasonality with fourth quarter gains. Additionally, we have broadly seen Q4 earnings estimates hold steady, while downward revisions are typically the norm. It may be worthwhile to look for opportunities, but caution is warranted. Small-cap quality is spotty — some 46% of the Russell 2000 is not profitable.