New 401k Options

Last month, President Trump made an executive order creating a pathway for certain “alternative assets” to be included as investment options in 401k plans. These new options can include real estate, digital currencies and private equity funds. While some of these assets are readily available for investment to individual investors, the private equity has traditionally been tougher to access. They may soon be available, but should employees look to allocate some of their retirement savings to those private equity investments?

The Basics — Private equity firms raise funds from investors to invest in companies that are not publicly traded on stock exchanges. Private equity firms work with the management of companies to increase their values and eventually profit from the companies’ sales to another investor, acquisitions by another firm, or through a public stock offerings. Because of the longer-term nature of the underlying investments, the funds tie up investors’ capital for long periods.

Review — Private equity has always been around, but gained traction after the noted head of Yale University’s endowment pioneered a strategy heavily utilizing very-illiquid investments like private equity. The strategy tries to capture the excess return offered in exchange for not being able to access the funds. Private equity funds became popular with endowments and institutions as well as high-net-worth individuals, because those investors could afford to weather the illiquidity and had the assets to meet the high minimum investments.

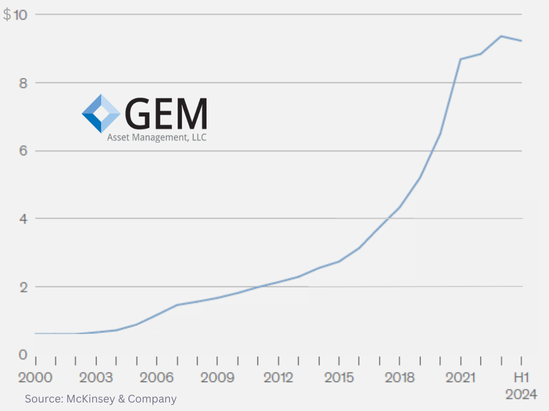

Worldwide Private Equity Assets Under Management

(trillions of dollars)

A Push for More Assets — Here at GEM, we have noticed steady growth in the number of emails trying to coerce us into investing client assets in private equity or credit. The growth in private equity assets under management has flattened somewhat since Covid, but the private equity sector is very profitable for participating firms. One estimate says that if just 10% of the target-date retirement funds in 401k pans converted to private equity funds, it would generate an additional $4 to $5 billion in fees for the managers.

Should private equity options become available in 401k retirement plans, we would suggest being cautious about venturing in too heavily, if at all. Because the investments are not in publicly traded securities with available valuation data, true valuations are not known until the investment is divested. So, the risks and returns of these investments are not very transparent and difficult to analyze.

Valuations — Periodically, but not always that frequently, private equity funds analyze the companies they’ve invested in and utilize different methods to value the investment at that point in time. These involve a number of assumptions by the private equity firm that create conflicts of interest.

- Management fees are based on those valuations, so there is incentive to use assumptions that might inflate valuations.

- Some studies have seen private equity valuations hold up while publicly traded companies have seen dramatic declines. This suggests that private equity has less volatility and/or risk that public investments which may not necessarily be true.

Management Fees — Keeping expenses low is foundational to us at GEM. The less you pay, the more of your investments’ return you keep. Private equity firms, however, are known to be among those in the “2 and 20” class, meaning a 2% management fee and 20% of the profits charged as a performance fee. This is much higher than the typical index fund that charging 0.1% or less.

Underlying Investments — Because the companies being invested in are private, actual financials and other data is not readily available. But we have seen studies that suggesting that compared to publicly traded peers, the private equity portfolio companies are frequently smaller in size, more highly leveraged and pay higher rates of interest. These are not characteristics that would suggest less risk.

We always include retirement plan assets in our clients’ financial plans, and very often help them evaluate investment options and manage those accounts. If you have questions, we would be happy to help by providing you with an investment review or “second opinion.”