Unequal Indices

Index fund investing has grown in popularity among many investors. The concept has many real advantages — scant research, no trading and minimal costs. The approach was really pioneered by John Bogle, who founded Vanguard in 1975 and grew it to be the largest mutual fund company in the world over the next 35 years. However, index investing is not without its nuances.

The Basics — An index is a “basket” of securities whose combined changes in value are meant to measure the performance of the overall market, or a subset of the market. The individual securities’ weightings in the index are either by the size of the company (capitalization- or cap-weighted), or are equal to all the other index members. Index funds mirror these allocations and are meant to replicate the performance.

The Big 3 of securities indices, S&P/Dow Jones, MSCI and Russell create indices to track various segments of the market based on various elements. These segments can include companies that are all small, medium, or large; may have value or growth characteristics; or are located in the US, or developed or emerging international markets.

Details — There are numerous funds tracking these indices. And yet, there can be drastic performance differences between funds tracking the same market sector because each of those companies has their own take on how to construct an index. For example, is a $10 billion company small, mid or large? Is South Korea an emerging or developed market?

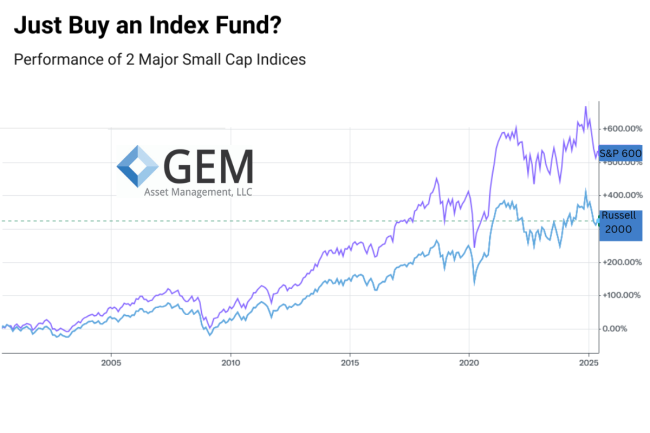

Why It Matters — There are many indices and index funds, but the chart above shows the performance of two tracking US small-cap stocks. Both indices seek to track the performance of the same segment of the stock market, but there is a dramatic difference between their performances over the past 25 years. Investors deciding to just buy a small cap index fund could see large differences in the size of their investments depending on which fund they chose.

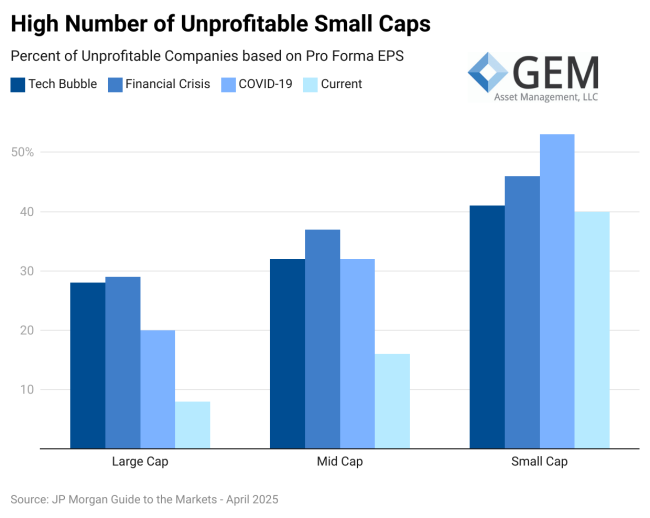

Our Thoughts — GEM believes in index funds and uses them strategically in client portfolios as investment options. However, our selection process focuses on evidence-based research that has identified investment factors that have historically generated better returns. One of the factors is profitability.

Zoom In — Overall the two indices are constructed similarly in terms of company size, exposure to industries, valuations, etc. However, The S&P 600 uses an earnings screen to exclude firms without a history of positive earnings. A large number of small, publicly-traded companies are not profitable and that screen filters out lower-quality firms.

Go deeper — Profitability is one factor GEM emphasizes, but there are others. Continuing to examine small cap stocks, we have found that companies exhibiting Value characteristics have performed better.

The Big Picture — Passive investing in index funds is a great concept, but it can’t be completely hands-off. Choosing which index to invest in is an active decision with consequences. There are differences in the approaches to constructing the indices and continuous turnover. Determining which companies are included or excluded from an index is an active decision. We believe managing investments by applying a factor-based process in coordination with low-cost index-based funds can be a good approach.